STRATEGY AT A GLANCE

Strategy

Yield and Growth

Inception

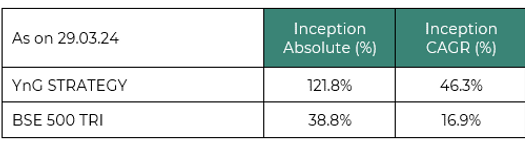

January 27, 2021

Market Cap

Multi-cap

Sectors

Agnsotic

Holdings

10-15

Benchmark

BSE 500 TRI

Investment Style

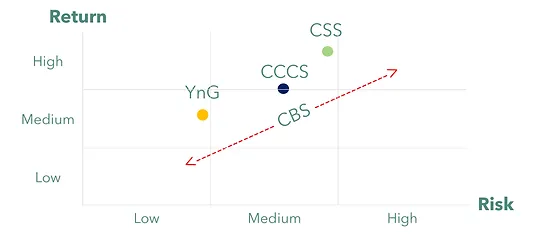

Quality growth at a reasonable price

Investment Horizon

Medium to Long Term