STRATEGY AT A GLANCE

Strategy

Captures growth in Indian economy

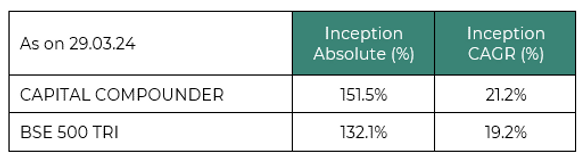

Inception

May 15, 2019

Market Cap

Across cap

Sectors

Agnostic

Holdings

20-25

Benchmark

BSE 500 TRI

Investment Style

Quality growth at a reasonable price

Investment Horizon

Medium to long term