We are primarily growth investors. We never buy something just because it’s cheap. Of course, we like cheap stock provided it is growing. So, growth is very, very essential to us. We look at growth in into two baskets – Magic Basket and Compounder basket.

The Magic Basket aims at capturing magic moments in the lifecycle of a company resulting in growth & valuation re-rating.

While the literal meaning of Magic is having supernatural power/qualities, however, in the Carnelian investing world, Magic moments are change/catalysts in the life of a company – when the company gets into a new growth trajectory, but not recognized by the Markets.

Markets starts recognizing them as the change unfolds over a period of time, leading to a valuation re-rating, thereby creating a significant wealth generation opportunity.

Objective: Capture “magic moments” in a company’s lifecycle that result in significant growth and valuation re-rating.

Portfolio Allocation: This strategy typically makes up 50-60% of the portfolio.

Investment Strategy: Focus on businesses showing a significant acceleration in growth, surpassing their historic growth trajectory, driven by key catalysts that are not yet fully recognized by the market.

Key Catalysts for

Acceleration

New Growth Catalyst

Product Innovation

Completion of Capex Phase

Change in Industry Structure

Management/CEO Change

Historical

Challenges

Good business + average management/CEO

Good business + average management/CEO

Good business + average management/CEO

Good management + low returns due to long gestation investment

The catalyst can be either one of or a combination of the above.

Through our decades of investing experience, we have found that post such events, companies usually deliver superior returns over a long period of time. Of course, one has to put in lot of effort in understanding these catalysts to get it right.

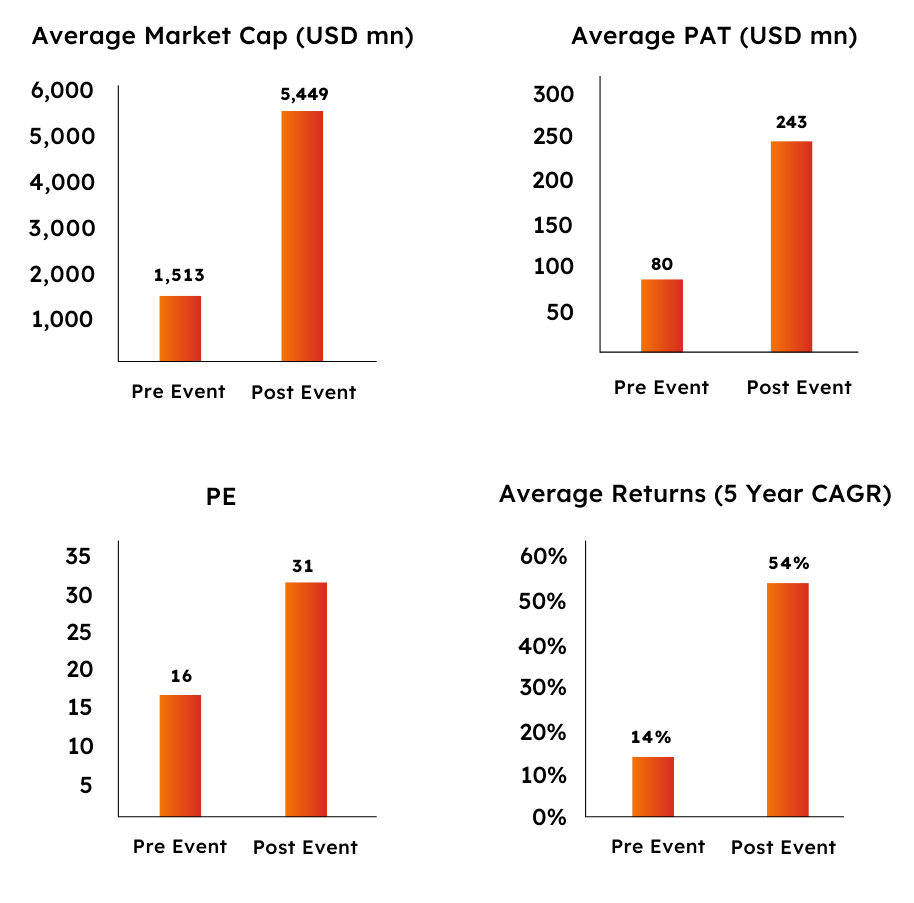

We have deep dived into a universe of 250 companies to back test our magic hypothesis – preceding 5 years to the magic event, average returns were ~14% CAGR vs ~54% CAGR for the following 5 years (post magic event). Even after adjusting for cases where the magic event did not played out, this number goes down to 56%. Of course, one would not be able to capture all the opportunities all the time and there could be some survivor bias, but this framework helps in capturing great opportunities.

The data below illustrates Returns for pre-magic /post-magic period

The Compounder Basket aims at capturing earnings growth over a long period of time. Many companies having created a significant moat around their businesses, managed by exceptionally talented managers, delivers a superior stable return over a long period of time. Such companies are usually well discovered, well owned, richly valued and remain so as long as MRFG characteristics are intact.

Objective: Achieve superior stable returns by investing in businesses with sustainable growth, efficient capital allocation, and the ability to compound returns over a 5-year investment horizon.

Portfolio Allocation: This strategy constitutes 40-50% of the portfolio.

Key Traits for Investment

Moat: Focus on stable businesses with a large opportunity size and a sustainable competitive advantage (“moat”).

High ROE (Return on Equity): Prioritize businesses that demonstrate efficient capital allocation resulting in high returns on equity.

Growth & Governance: Invest in businesses that are not only growing but also have strong governance practices.

Robust Free Cash Flows: Target companies with strong and consistent free cash flow generation, indicating a well-established and resilient business model that performs well across economic cycles.

15%

Alpha CAGR

17%

Sales CAGR

21%

PAT (Profit After Tax) CAGR

26%

Average ROE

31%

Market Cap CAGR

The strategy emphasizes investing in stable businesses at “fair” valuations, which leads to compounding returns over time.

The information, content and data of this website is for general information purposes only and do not constitute distribution, an offer to buy or sell or solicitation of an offer to buy or sell any units of the funds or its schemes or portfolio management services (hereinafter referred as “Products* of Carnelian Asset Management & Advisors Pvt. Ltd. or it’s affiliates, division or branch (“Carnelian” in any jurisdiction in which such distribution, sale or offer is not authorized The material/information provided in this website is for the limited purpose of information only for the public in general or as might have been mandated by the regulatory authority.

Carnelian makes no warranties that information on this website is appropriate or available for use in any jurisdictions outside India. In particular, the information herein is not for distribution and does not constitute an offer to buy or sell or solicitation of an offer to buy or sell any Products managed by Carnelian to any person residing in the United States of America (USA’/Canada. This website is not directed to any person in any jurisdiction outside India where the publication or availability of this website is prohibited by reason of that person’s investment profile, nationality, residence or otherwise. Where it is illegal or prohibited in the user’s country of origin to access or use this Website, then the user should refrain from doing so. Those who choose to access this Website from outside India do so on their own initiative and are responsible for compliance with all applicable laws and regulations The products or services mentioned on the website have not been, and will not be, registered under the Securities Act, or any state law of the United States, and may not be offered or sold within the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and accordingly, the products being offered and sold (i) within the United States solely to persons who are reasonably believed to be “qualified institutional buyers” (as defined in Rule 144A under the U.S. Securities Act) in transactions exempt from the registration requirements of the U.S. Securities Act, and (il) outside the United States in “offshore transactions” as defined in and in compliance with Regulation S under the U.S. Securities Act and the applicable laws of the jurisdiction where those offers and sales occur.

By entering this website or accessing any data contained in this website, /We hereby confirm that I/We am/are not a U.S. person, within the definition of the term ‘US Person’ under the US Securities laws/resident of Canada. I/We confirm that, at the time of access, I/We (a) am/are located and resident in India; and (b) am/are not a resident of the United States and/or I/We am/are not located inside the United States or are a U.S. person or acting for the benefit or account of a U.S. person. I/We hereby confirm that I/We am/are not giving a false confirmation and/or disguising my/our country of residence. We agree and acknowledge that Carnelian is relying upon my/our confirmation and in no event shall the directors, officers, emplovees, trustees, agents of Carnelian, its associate/group companies be liable for any direct, indirect, incidental, or consequential damages arising out of false confirmation provided herein.

Select “Agree” to confirm that you agree to the above disclaimer.